san mateo tax collector property tax

With approximately 237000 assessments each year. San Mateo County Tax Collector.

2019 2022 Grant Street Group.

. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number. The San Joaquin County current year property tax roll is available online for inquiry or to make a payment by credit card debit card or E-Check. Request Full and Updated Property Records.

Ad Get Reliable Tax Records for Any San Mateo County Property. View public property records including property assessment mortgage documents and more. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in San Mateo County.

Property tax market value. Ad Online access to property records of all states in the US. The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800.

The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are. Ad Uncover Available Property Tax Data By Searching Any Address. Box 7426 San Francisco CA 94120-7426.

Accorded by Florida law the government of San Mateo public schools and thousands of various special units are given authority to evaluate real property market value set tax rates and. Payment plans may not be started online. Property Taxes for 191 West 25th Avenue San Mateo Access detailed property tax data for 191 West 25th Avenue San Mateo CA 94403.

The median property tax on a 78480000 house is 824040 in the United States. The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. Property Tax Bills and Refunds San Mateo County Assessor-County Clerk-Recorder Elections - ACRE.

San Mateo County collects on average 056 of a propertys. Look Up an Address in San Mateo County Today. The amount of taxes due for the current year can be found on the TreasurerTax Collectors web site or contact the Tax Collectors Office at 8662200308.

Top SEO sites provided San mateo county tax collector keyword. Announcements footer toggle 2019 2022 Grant Street Group. We Provide Homeowner Data Including Property Tax Liens Deeds More.

Office of the Treasurer Tax Collector PO. The median property tax on a 78480000 house is 580752 in California. View a property tax bill and make property taxes payments including paying online by mail.

San Mateo County Tax Collector. 1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov.

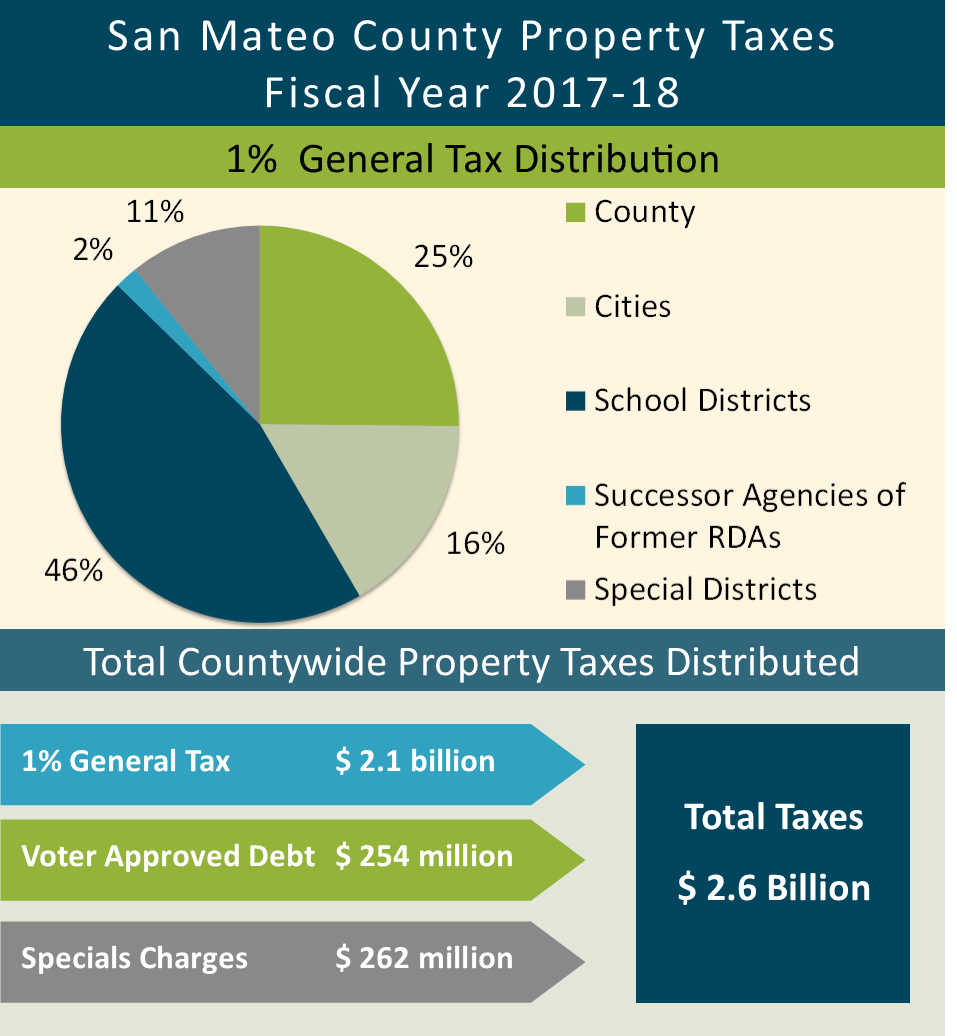

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

Where Do My Taxes Go County Of San Mateo Ca

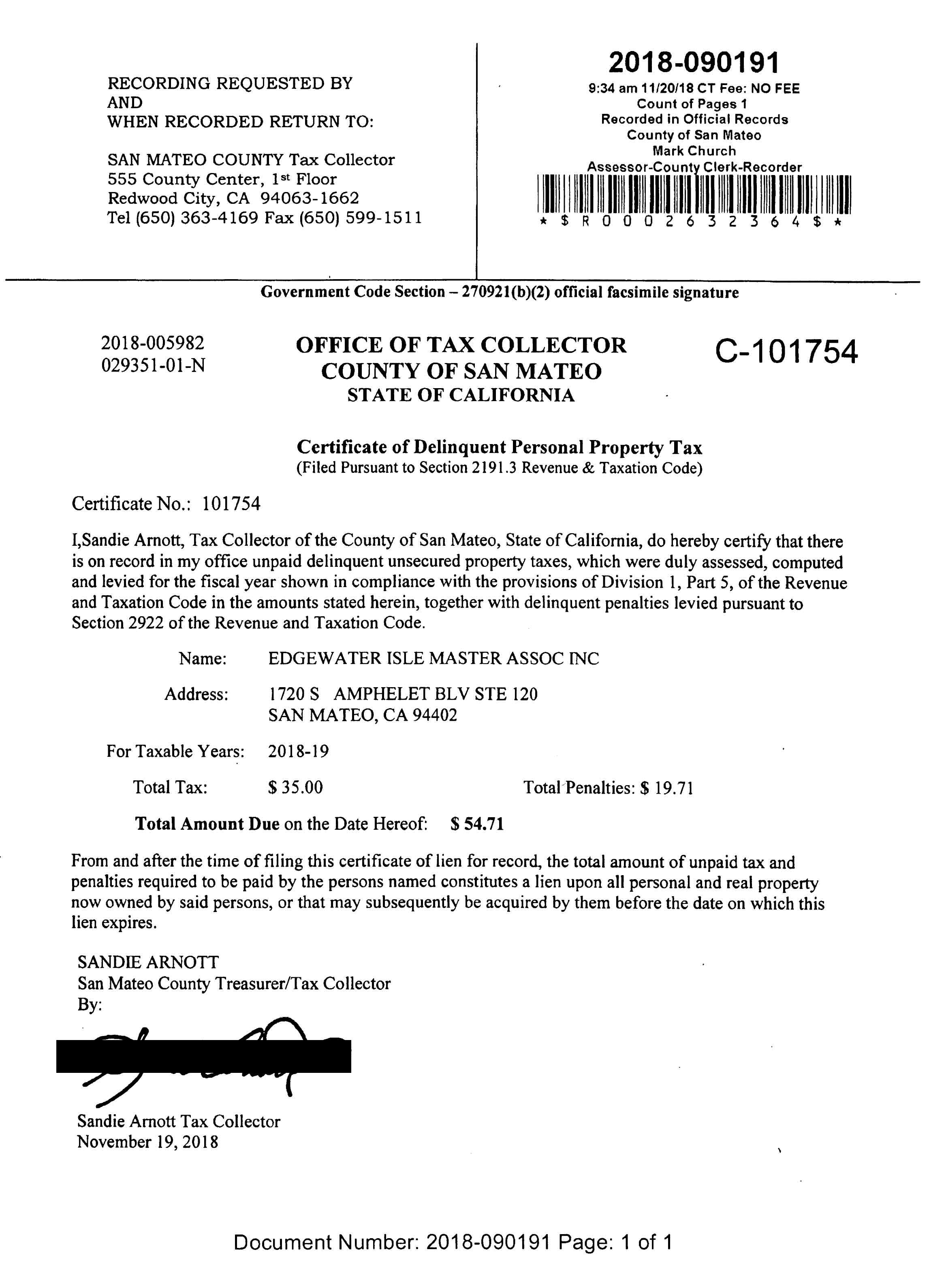

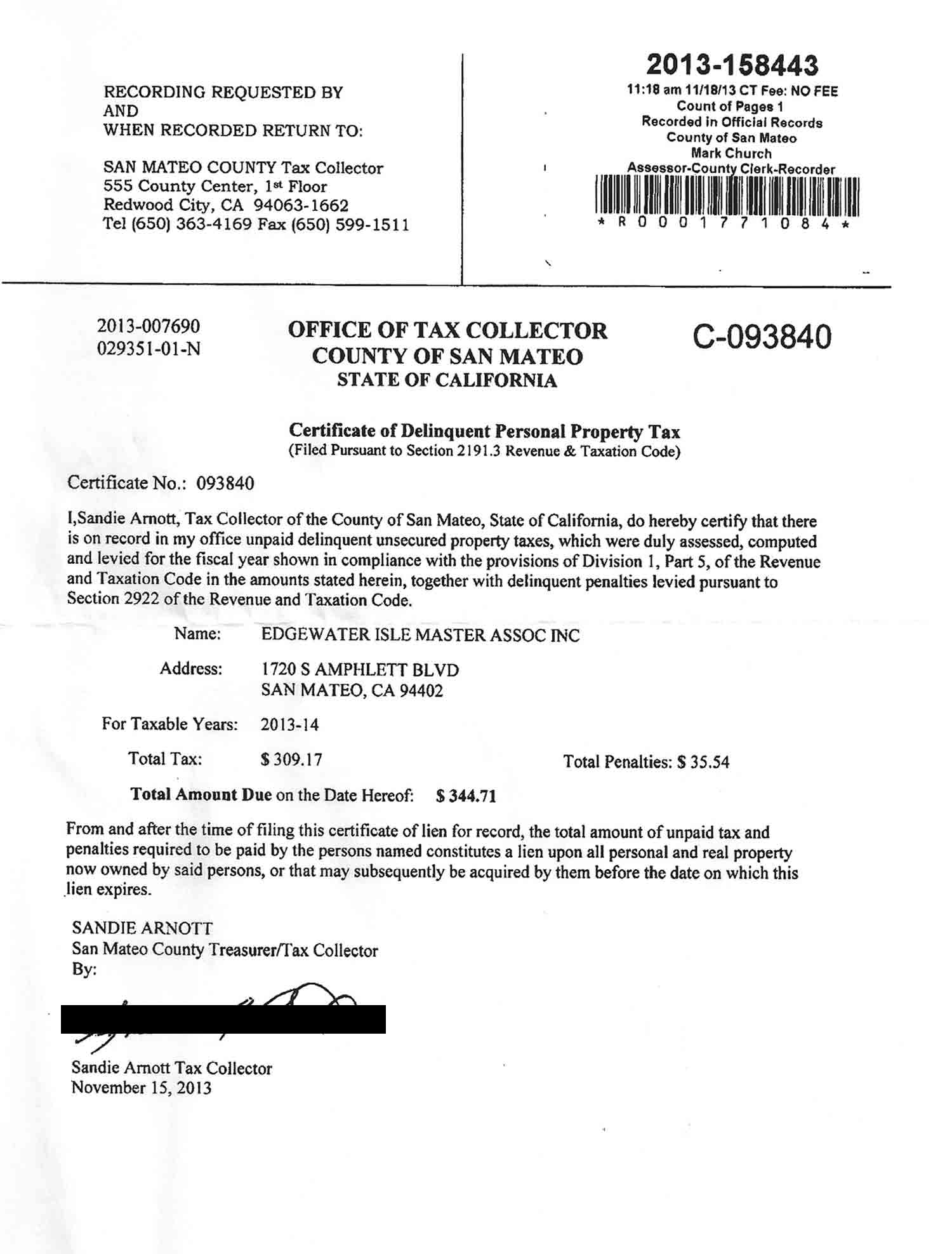

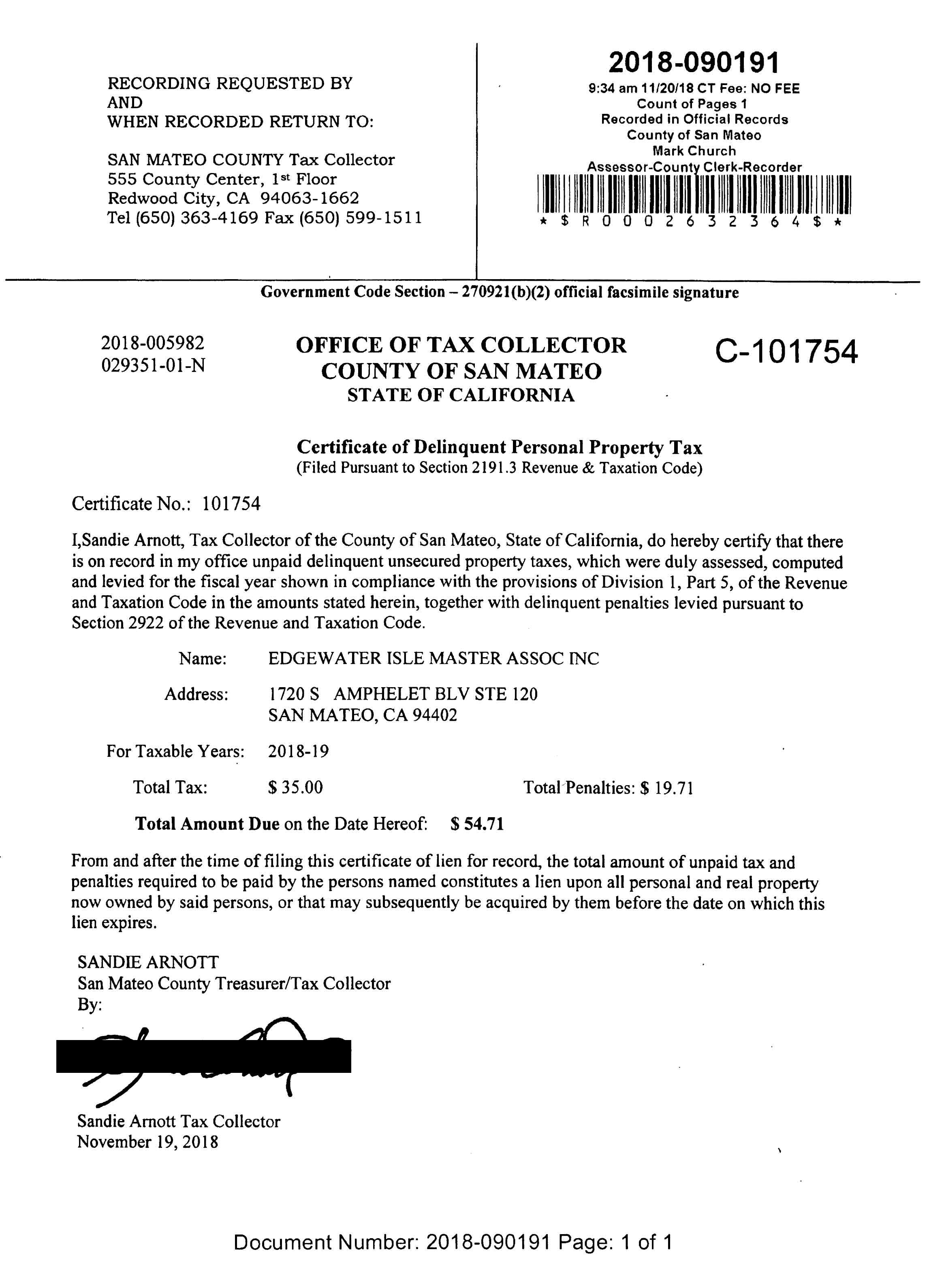

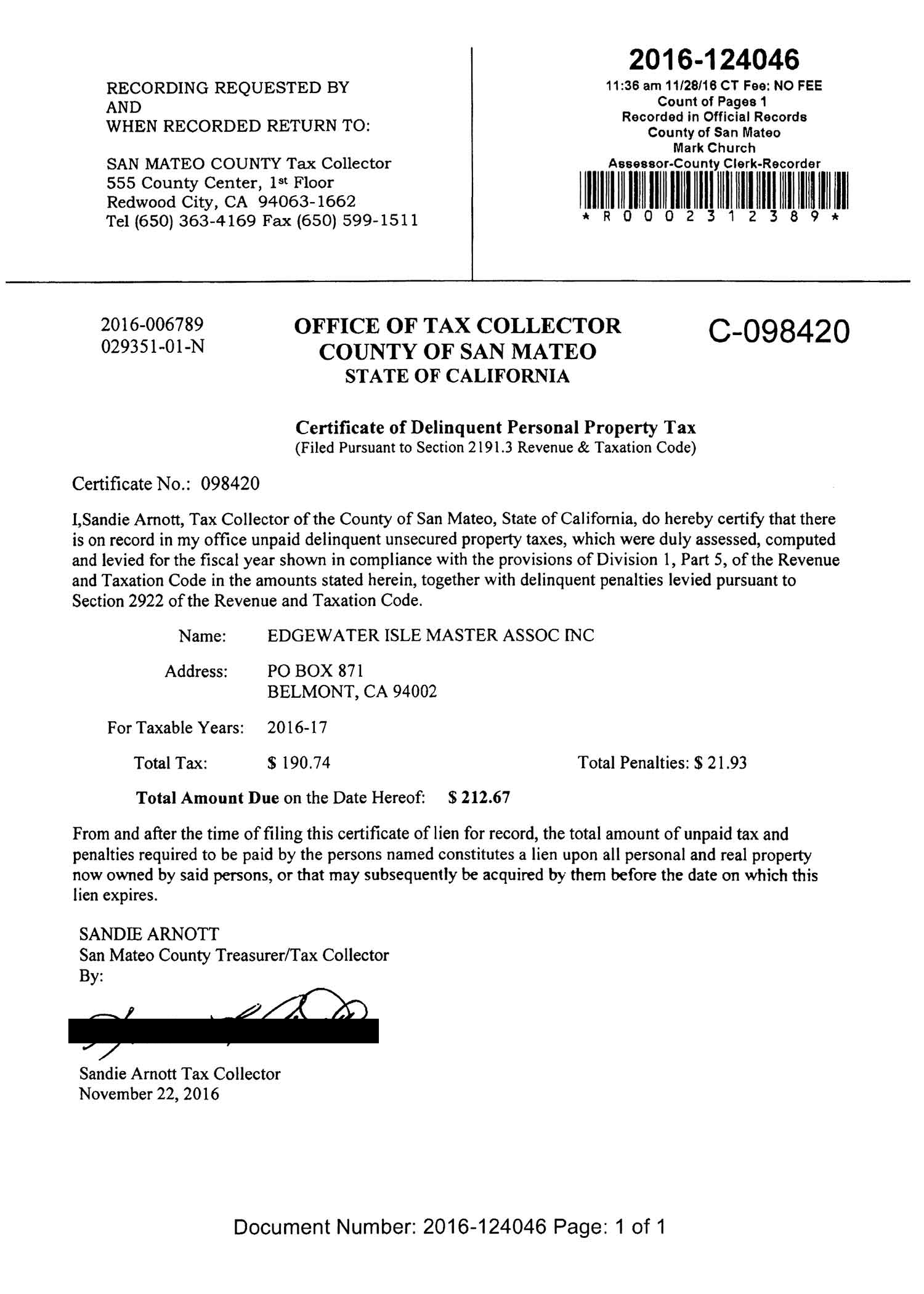

San Mateo County Issues Liens Against Master Association

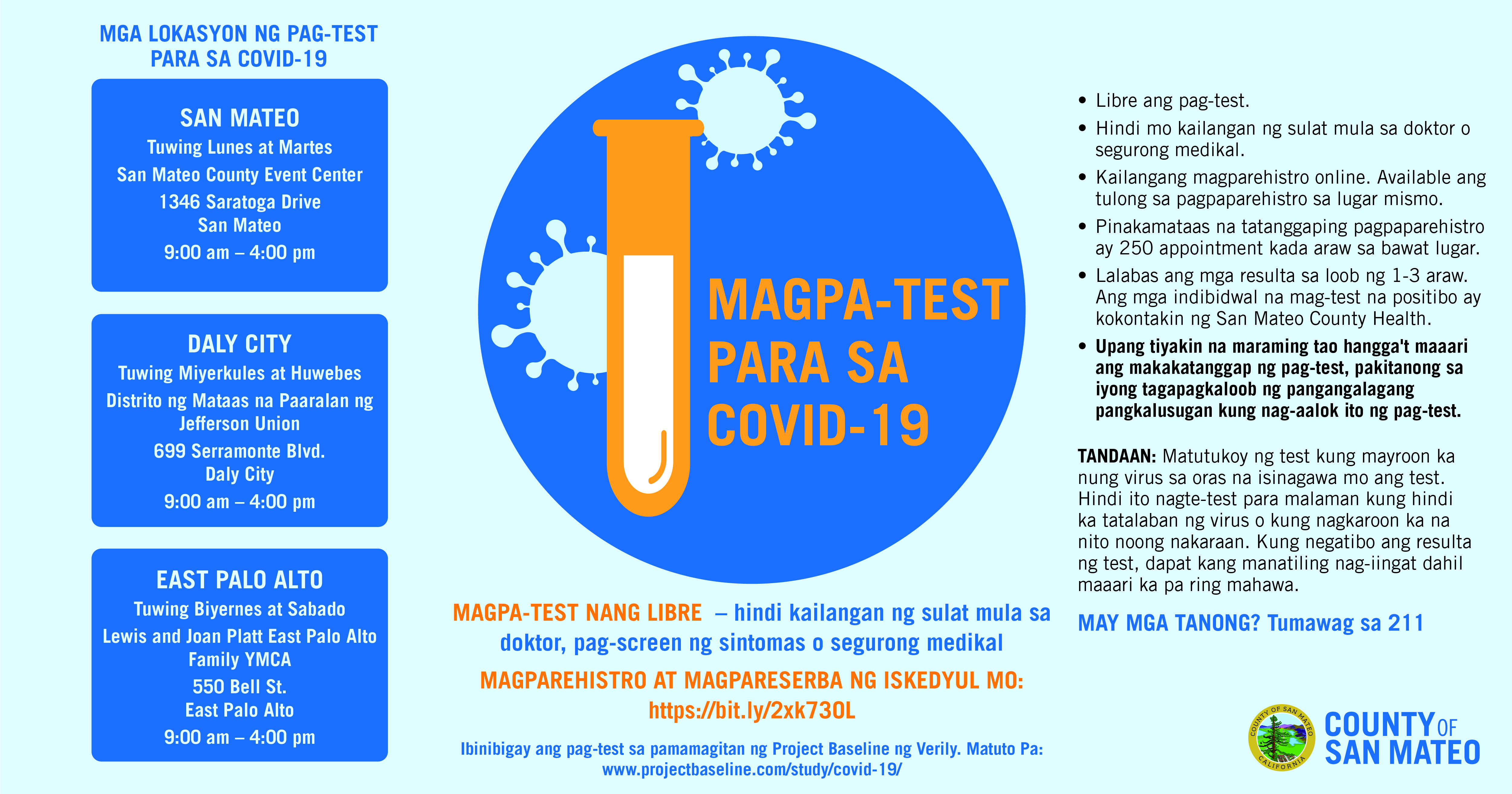

Get Free Testing Fliers And Social Media Graphics County Of San Mateo Ca

Pay Property Taxes Online County Of San Mateo Papergov

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

Charges On Property Tax Bill Montara Water Sanitary District

San Mateo County Issues Liens Against Master Association

San Mateo County Issues Liens Against Master Association

Gis Old Version County Of San Mateo Ca

County Of San Mateo California Selects Taxsys Pittsburgh Pa Grant Street Group

California Public Records Public Records California Public

San Mateo County Ca Property Tax Search And Records Propertyshark

County Controller Publishes Property Tax Highlights For Fy 2021 22 County Of San Mateo Ca